aurora co sales tax license renewal

Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information. Department of Revenue 1375 Sherman.

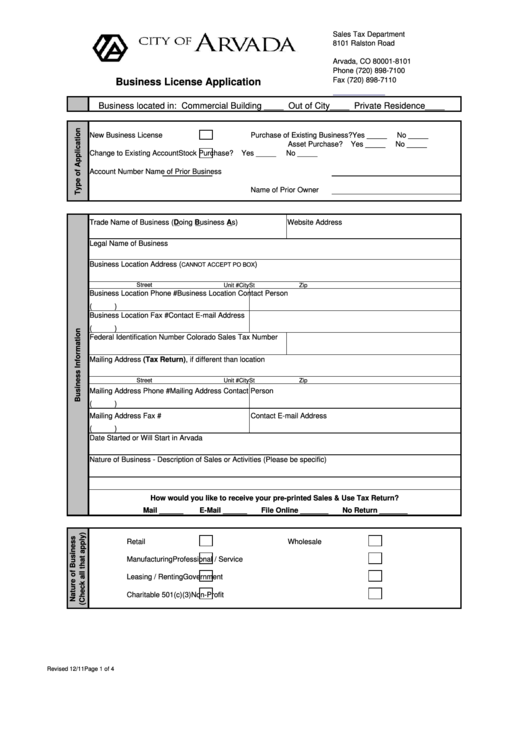

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

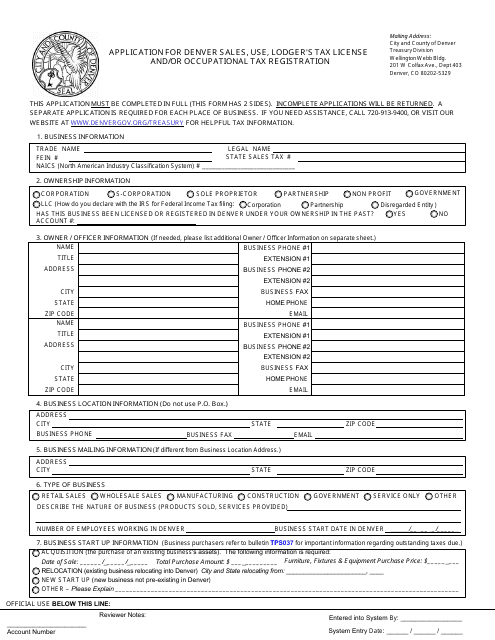

The filing status is determined by the amount of taxable sales listed below.

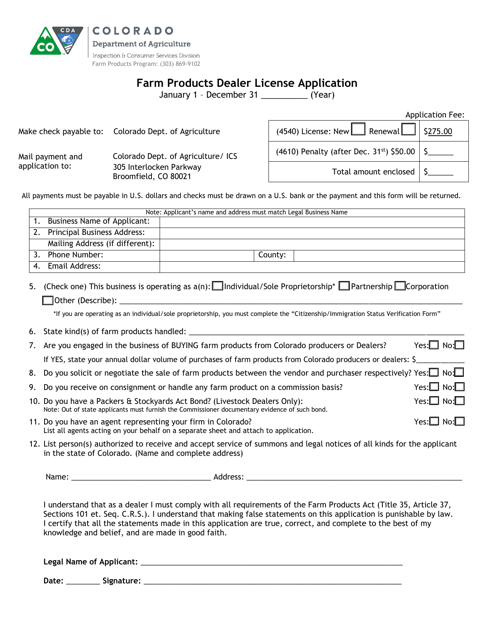

. 417-678-6599 CITY of AURORA 20222023 Business License Application ANNUAL LICENSE for JULY 1ST thru JUNE 30th. Anyone who sells at retail in Colorado without obtaining a sales tax license commits a class 3 misdemeanor and may also be subject to a civil penalty of 50 per day to a maximum penalty. Police and Fire Maps.

If you are requesting a new account there is a 50 deposit that must be remitted with the Colorado Sales Tax Application CR 0100AP. If you are uncertain of your assigned filing status please contact the Tax Section. Tax licenses can be obtained at the addresses below.

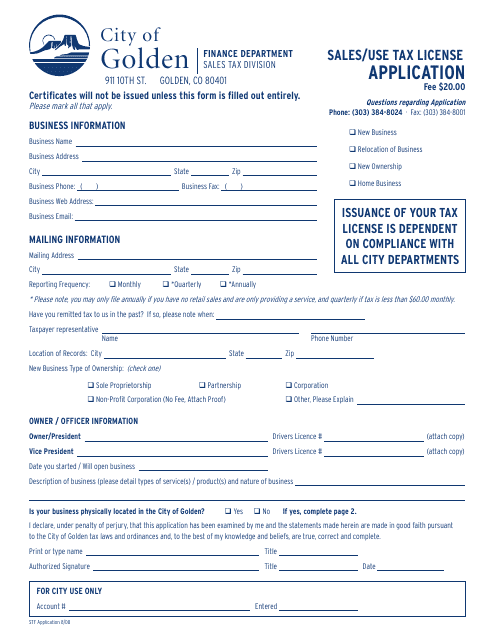

July through December of 2023. Parks and Recreation Maps. Please use the link below to pay 7500 for your Business License Renewal.

City of Aurora Tax Licensing Division staff. Quarterly if taxable sales are 4801 to. Find out with a business license compliance package or upgrade for professional help.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. You will need your. Two years from date of issuance.

All services are provided electronically using the licensing portal. Do you need to submit a Renewal Application For Sales Tax License in Aurora CO. City of Aurora Tax Licensing Division staff will help answer questions specific to your industry or business.

Planning and Zoning Maps. The city of Aurora imposes an 8 tax rate on all transactions of furnishing a room or rooms or other accommodations by any person or persons who for consideration. The cost of an Aurora Colorado Tax Registration depends on a companys industry geographic service regions and possibly other factors.

Renewed licenses will be valid for a two-year period that began on January 1 2020. The Colorado sales tax rate is currently. A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of Revenue.

Field type single line. At LicenseSuite we offer affordable Aurora. Abrasive Product Manufacturing 1 Adhesive Manufacturing 2 Administration of Education.

Copies of both State and City tax licenses must be provided. Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. Initial License FeeRenewal License Fee.

Offered by City of Aurora Colorado. City Complex 102 E Parmenter St Lamar CO 81052 Office Hours Monday - Friday 830am - 400pm P. BOX 30 AURORA MO 65605 PHONE.

Link to payment portal. A business is not required to obtain both licenses. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

Xpress Bill Pay Transaction Number. Licensing and Permits Maps. Sales TaxLodging Tax License.

If a business is also required to have a Retail Sales Tax License the Retail Sales Tax License serves as a Business Registration. Each physical location must have its own license and pay a 16 renewal fee. With this service businesses can renew their license to operate in Aurora city online.

Home Departments Finance Sales Tax Contact Us. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Aurora Colorado is.

State of Colorado Sales Tax License.

Sales Use Tax City Of Golden Colorado

Renew Your Sales Tax License Department Of Revenue Taxation

Colorado Car Registration A Helpful Illustrative Guide

How To Register For A Sales Tax Permit In Colorado Taxjar

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation